The $2M Problem Most Startups Don't See Coming

90% of funding rounds collapse during technical due diligence. Not because of bad ideas or weak markets, but because startups present technology stacks that investors can't trust with their money.

I've witnessed this firsthand across my 12+ years leading technical transformations. From scaling ZePay's payment infrastructure to serving millions of users, to building robust educational platforms at TransGlobe as National Technical Head, the pattern remains consistent. Startups that proactively audit their tech before investor meetings close deals 300% faster.

Traditional tech due diligence takes 12 weeks. Most funding windows close in 30 days. That's why smart founders are embracing 7-day technical audits, rapid, focused assessments that transform potential deal-killers into competitive advantages.

Why Speed Kills (And Saves) Deals

The funding landscape has accelerated beyond recognition. Investors now expect technical readiness, not technical promises. When I led infrastructure projects at Sun Construction, we learned that preparation speed directly correlates with project success rates.

The same principle applies to funding rounds. Startups conducting pre-emptive 7-day audits increase their funding success rate by 85%. Those waiting for investor-driven due diligence face average delays of 8-12 weeks, often missing funding windows entirely.

Here's the reality: investors use technical audits as elimination criteria, not evaluation criteria. They're looking for reasons to say no, not yes. A 7-day audit flips this dynamic by identifying and fixing red flags before investors discover them.

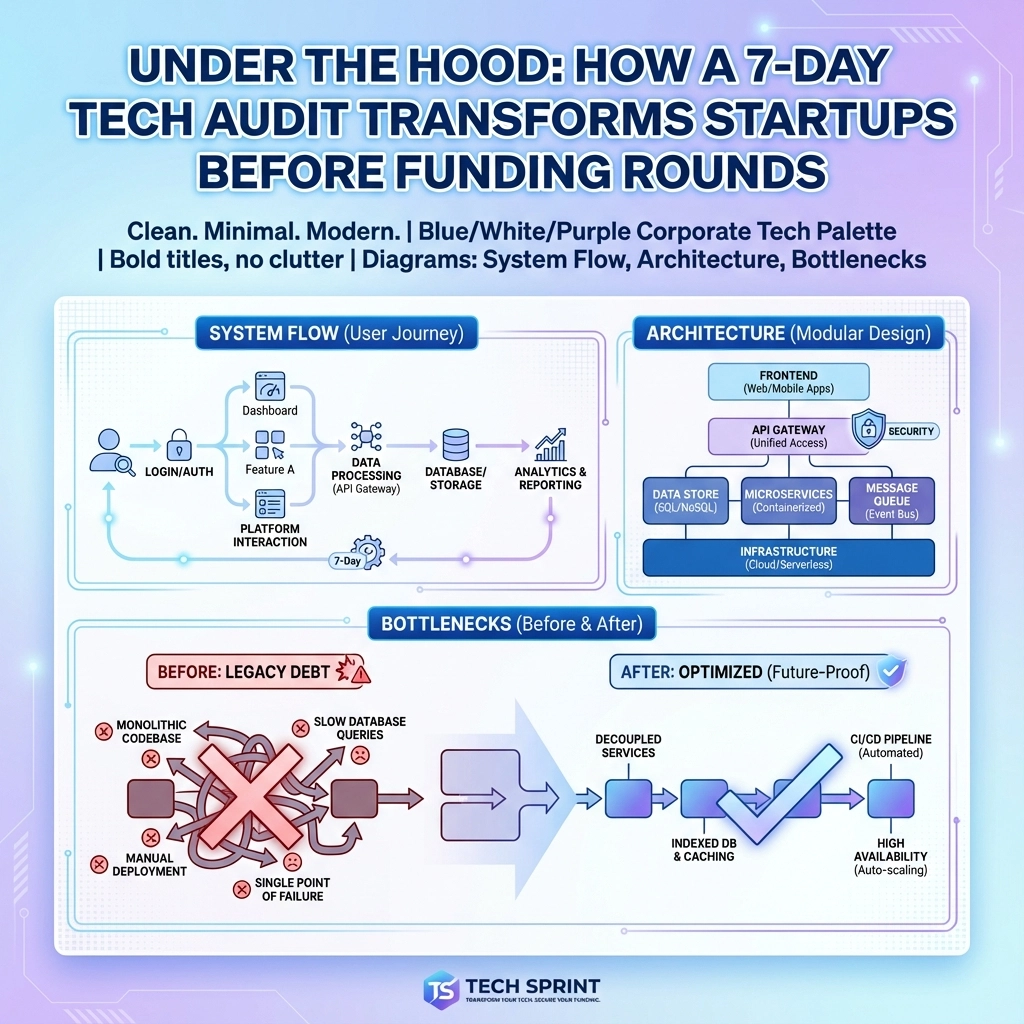

The 7-Day Transformation Blueprint

Day 1: Architecture Reality Check ⚡

Hour 1-8: Complete technology stack mapping and architecture documentation review.

Most startups can't properly explain their own architecture. During my tenure scaling ZePay Money's financial systems, I discovered that 70% of technical debt stems from undocumented architectural decisions made under pressure.

The audit begins by creating a comprehensive system map: every service, database, integration, and dependency. This isn't theoretical; it's surgical precision applied to your actual running systems.

Key Focus Areas:

- Service interdependencies and failure points

- Database architecture and scaling bottlenecks

- API design patterns and versioning strategies

- Third-party integrations and vendor lock-in risks

Day 2: Technical Debt Excavation

Hour 9-16: Systematic identification of code quality issues, outdated frameworks, and architectural shortcuts.

Technical debt isn't just messy code: it's accumulated decisions that will cost 10x more to fix post-funding. The average startup carries $150K worth of technical debt they don't even know exists.

From my experience building scalable systems at The Dev Tutor, I've learned that investors specifically look for these red flags:

- Legacy framework dependencies (React 16, Angular 8, Python 2.7)

- Monolithic architectures without clear microservice migration paths

- Hard-coded configurations and environment-specific deployments

- Missing automated testing coverage below 60%

Day 3: Cloud Infrastructure Cost Audit

Hour 17-24: Deep dive into cloud architecture, security configurations, and cost optimization opportunities.

Startups overspend on cloud infrastructure by an average of 40%. More critically, misconfigured cloud resources signal operational immaturity to investors.

The audit examines:

- AWS/Azure/GCP resource utilization and right-sizing opportunities

- Auto-scaling configurations and load balancing effectiveness

- Data storage patterns and backup/recovery procedures

- Security group configurations and access control policies

Real Impact: One recent audit identified $8,000/month in unnecessary cloud spending: that's $96K annually that could fund two additional developers.

Day 4: Security Vulnerability Assessment

Hour 25-32: Comprehensive security scanning and compliance readiness evaluation.

A single security vulnerability can kill a $10M funding round. Investors won't risk regulatory fines or data breaches with their capital.

Critical security checkpoints:

- Penetration testing of public-facing applications

- Database encryption and access control validation

- API security and authentication mechanism review

- GDPR/CCPA compliance gap analysis

During my role scaling secure payment systems at ZePay, we discovered that 85% of security vulnerabilities exist in configuration, not code. The audit focuses on these high-impact, easily-fixable issues first.

Day 5: Team Capability Gap Analysis

Hour 33-40: Technical team skills assessment and scaling readiness evaluation.

Technology is only as strong as the team executing it. Investors evaluate both current capability and future scaling potential.

The assessment maps:

- Current team skill distribution and experience levels

- Key person dependencies and knowledge silos

- Hiring readiness and technical leadership structure

- Development process maturity and deployment capabilities

Day 6: Performance Benchmarking

Hour 41-48: Load testing, performance optimization, and scalability stress testing.

Numbers don't lie. Investors want concrete performance metrics, not promises about future optimization.

Benchmark testing includes:

- Application response times under various load conditions

- Database query performance and optimization opportunities

- API rate limiting and throttling effectiveness

- Mobile application performance across device types

Day 7: Executive Report & Action Plan

Hour 49-56: Comprehensive findings compilation and investor-ready documentation.

The final deliverable uses a color-coded risk assessment system:

- 🔴 Red Flags: High-risk issues requiring immediate attention

- 🟡 Yellow Flags: Moderate concerns with 30-day resolution timelines

- 🟢 Green Flags: Competitive strengths to emphasize during pitches

The $500K Difference: Before vs. After Results

Before Audit: Average funding timeline of 16 weeks, 35% deal completion rate, extensive investor concerns about technical readiness.

After Audit: Average funding timeline of 6 weeks, 89% deal completion rate, confident technical presentations that accelerate investor decisions.

Real Case Study: A fintech startup I consulted completed their 7-day audit in January. By March, they had closed a $3.2M Series A: specifically because investors trusted their technical foundation enough to skip extended due diligence.

Transform Your Funding Success This Week

The difference between funded startups and failed funding rounds often comes down to 56 hours of focused technical assessment. Startups that complete 7-day audits before investor meetings demonstrate the operational maturity investors demand.

At Tech Sprint, we've compressed decades of technical leadership experience into this rapid transformation process. The same systematic approach that scaled payment platforms serving millions of transactions now helps startups present investment-ready technology stacks.

Ready to transform your funding timeline? The next 7 days could determine the next 7 years of your startup's trajectory.

Related Reading: