India's decisive action on online betting represents a bold step toward securing the digital finance ecosystem and protecting citizens from sophisticated cybercrime networks. The Promotion and Regulation of Online Gaming Act, 2025, passed on August 20, demonstrates how proactive legislation can disrupt criminal financial flows and establish stronger digital security frameworks.

Dismantling Traditional Money Laundering Networks

The betting ban has immediately severed criminal access to India's regulated banking system for illicit activities. By prohibiting banks and financial institutions from processing funds for real-money gaming platforms, authorities have eliminated a primary channel that criminal organizations previously used for money laundering operations.

This regulatory approach creates mandatory surveillance checkpoints across all legitimate financial transactions. When betting activities were integrated into the formal banking system, criminals could disguise illegal funds within the massive volume of gaming transactions. The ban forces all suspicious financial activity into alternative channels that are easier for law enforcement to monitor and investigate.

Government data indicates that formal financial institutions were processing over ₹2.3 trillion in annual gaming-related transactions before the ban. This massive flow provided perfect cover for laundering proceeds from drug trafficking, human trafficking, and other serious crimes. The immediate cessation of these flows has created a significant operational disruption for organized crime networks.

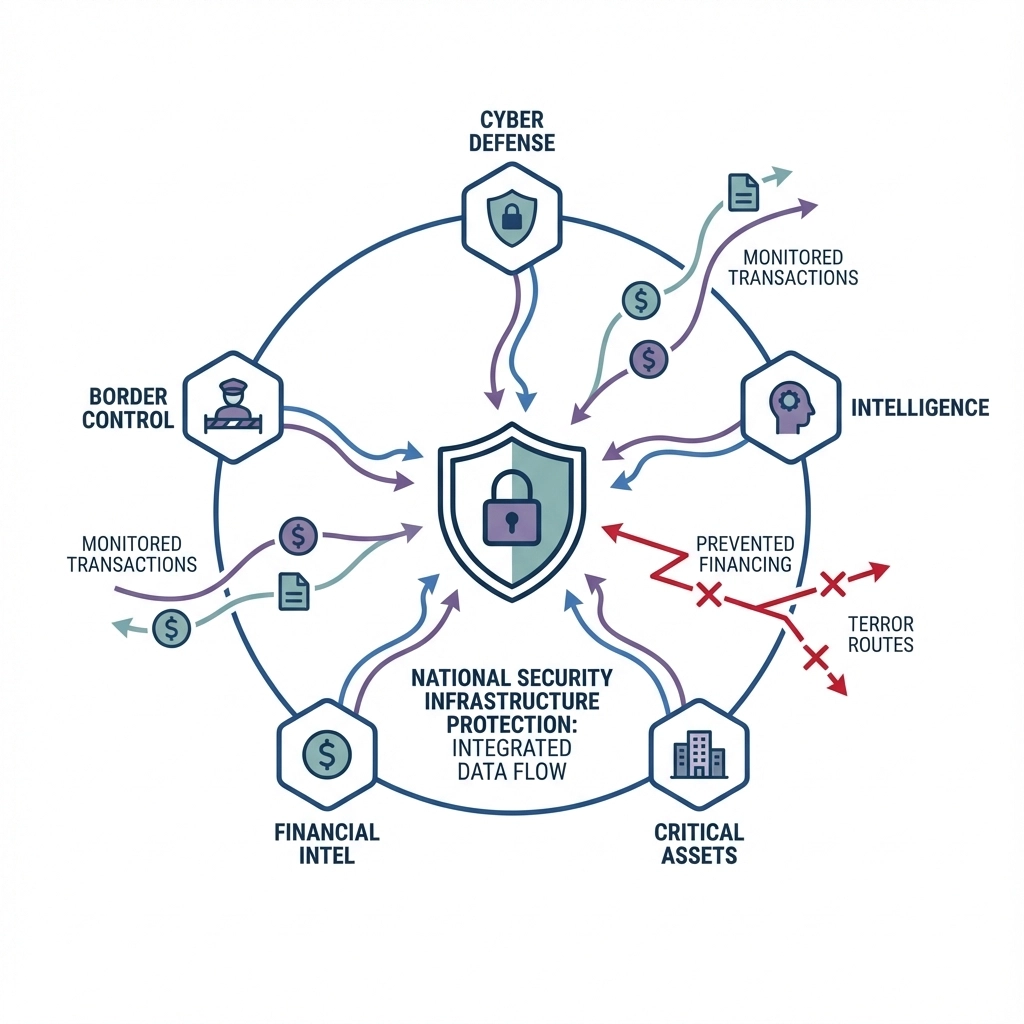

Strengthening National Security Infrastructure

The ban directly addresses terror financing concerns that security agencies identified within the online gambling ecosystem. Terror groups were exploiting the rapid transaction processing and minimal verification requirements of betting platforms to move funds across international borders.

Intelligence reports revealed that encrypted wallet systems integrated with betting platforms provided an ideal mechanism for terror financing. Criminal organizations could deposit funds through seemingly legitimate gaming activities, then extract clean money through coordinated withdrawals across multiple jurisdictions.

By eliminating these platforms from India's financial infrastructure, the government has closed a critical vulnerability in the nation's security apparatus. Terror groups must now rely on more traditional, traceable methods that security agencies are better equipped to detect and intercept.

The legislation also enhances cross-border financial surveillance. When betting platforms operated within India's regulatory framework, they created complex international payment flows that were difficult for authorities to track. The ban simplifies the landscape, making suspicious international transfers more visible to financial intelligence units.

Protecting Citizens from Digital Fraud Schemes

Online betting platforms had become primary vectors for sophisticated fraud operations targeting Indian consumers. The ban eliminates these platforms as entry points for cybercriminals seeking to exploit vulnerable users through fake promotions, rigged games, and identity theft schemes.

Phishing attacks specifically targeted betting platform users, who were conditioned to provide sensitive financial information quickly. Criminals created convincing replica sites that harvested banking credentials, Aadhaar numbers, and mobile OTP codes from unsuspecting users. The elimination of legitimate betting sites reduces user confusion about which platforms are authentic.

The ban also addresses predatory lending schemes that were integrated with many betting platforms. Criminals offered instant loans to gambling addicts, then used aggressive collection tactics that often involved threats and harassment. These operations frequently extracted far more money than the original loans through hidden fees and compound interest structures.

Enhancing Corporate Cybersecurity Standards

The legislative action has accelerated cybersecurity improvements across India's fintech and gaming sectors. Companies that previously operated in the betting space are now redirecting their security investments toward more transparent, regulated activities that benefit the broader digital economy.

Technology teams that specialized in betting platform security are now applying their expertise to legitimate fintech applications, payment processors, and digital banking solutions. This talent reallocation strengthens cybersecurity across sectors that directly benefit Indian consumers and businesses.

The ban has also eliminated compliance confusion that previously existed around gaming regulations. Companies can now focus their legal and security resources on clear regulatory frameworks rather than navigating the complex, often contradictory requirements that existed in the online betting space.

Driving Innovation in Secure Digital Payments

Without the betting industry's demand for rapid, low-friction payment processing, fintech companies are investing in more secure payment authentication methods. The pressure to enable instant deposits for gambling activities often led to security shortcuts that created vulnerabilities across the entire payment ecosystem.

Biometric authentication and multi-factor security protocols are now receiving greater investment priority as payment processors focus on serving legitimate e-commerce and financial services rather than optimizing for gambling transactions. This shift benefits all digital payment users through enhanced security standards.

The reallocation of technical resources has accelerated development of fraud detection systems specifically designed for India's unique digital payment landscape. Machine learning algorithms previously used to detect betting fraud are now being refined to protect users across legitimate digital finance applications.

Strengthening Regulatory Enforcement Capabilities

The betting ban has simplified the regulatory landscape for financial crime investigators, allowing them to focus resources on clearly illegal activities rather than monitoring the gray areas that existed around online gambling. This clarity enhances the effectiveness of existing cybercrime units.

Law enforcement agencies report that the ban has made it easier to distinguish between legitimate fintech innovation and potentially criminal activities. When betting platforms operated in regulatory gray areas, investigators often spent significant time determining whether specific activities were legal before pursuing enforcement actions.

The legislation has also improved coordination between financial intelligence units and cybercrime investigators. With betting-related transactions eliminated from the formal banking system, suspicious activity reports now more clearly indicate genuine criminal behavior rather than legitimate gambling activities.

Long-term Digital Security Benefits

The ban establishes important precedents for proactive cybersecurity regulation in emerging technology sectors. By acting decisively on online betting, the government demonstrates willingness to prioritize citizen protection over industry revenue when security risks become apparent.

International cooperation on cybercrime has improved as India's clear regulatory stance makes it easier for foreign law enforcement agencies to share intelligence about cross-border criminal activities. Many countries struggled to provide assistance when online betting occupied a legal gray area.

The legislation also creates incentives for legitimate fintech innovation by removing the competitive pressure to match the loose security standards that many betting platforms employed. Legitimate financial technology companies can now compete on security quality rather than transaction speed alone.

Building Consumer Confidence in Digital Finance

By eliminating the most problematic actors from the digital payments ecosystem, the ban enhances overall consumer trust in legitimate fintech services. Users who previously avoided digital payments due to security concerns about gambling-adjacent platforms are now more likely to adopt secure financial technology.

Educational campaigns about digital security are more effective when consumers aren't simultaneously exposed to betting platforms that deliberately encourage risky financial behaviors. The cleaner digital landscape makes it easier for consumers to distinguish between safe and dangerous online financial activities.

The regulatory clarity provided by the ban enables more effective consumer protection programs, as financial literacy initiatives can focus on legitimate use cases rather than warning about the complex risks associated with online gambling platforms.

India's betting ban represents a comprehensive approach to digital security that prioritizes long-term citizen protection over short-term industry convenience. While enforcement challenges remain, the foundational security benefits of eliminating these criminal channels from India's financial system create lasting improvements to cybersecurity across the digital economy.