The recent online gaming ban in India has fundamentally reshaped the digital entertainment landscape, and while initial reactions focused on industry disruption, forward-thinking entrepreneurs are discovering unprecedented opportunities for innovation. The regulatory shift has created a $2.8 billion market gap that Indian startups are uniquely positioned to fill with compliant, culturally relevant gaming solutions.

The Silver Lining: Regulatory Clarity Drives Innovation

After years of uncertainty, the Promotion and Regulation of Online Gaming Act of 2025 has provided crystal-clear guidelines that savvy developers are leveraging to build sustainable gaming ecosystems. E-sports platforms have seen a 340% increase in user engagement since the ban, as players and investors redirect their attention to skill-based competitive gaming.

Gaming startups focusing on educational content, social interaction, and skill development are experiencing their golden moment. The regulatory framework explicitly protects and encourages these segments, creating a stable foundation for long-term growth that was previously overshadowed by the volatility of real-money gaming.

Homegrown Giants Are Already Emerging

Mobile Premier League (MPL) pivoted within 60 days to become India's largest skill-gaming platform, reporting 45 million active users in skill-based tournaments. Their transformation demonstrates how agile Indian startups can turn regulatory challenges into competitive advantages.

Loco, India's leading game streaming platform, secured ₹42 crores in Series A funding just three months post-ban, specifically targeting the content creation and community building space that the new regulations actively promote.

Key Success Metrics from Early Adopters:

- Skill-based gaming platforms: 280% user growth

- Educational gaming apps: 190% increase in daily active users

- Social gaming communities: 450% engagement boost

- Regional language gaming content: 320% content creation surge

The EdTech Gaming Revolution

Educational technology companies are discovering that gamification compliance opens unlimited growth potential. Byju's Games division launched 15 new learning modules post-ban, achieving 2.3 million downloads in their first quarter.

Indian startups like Practically and Vedantu are integrating advanced gaming mechanics into their learning platforms, creating immersive educational experiences that satisfy regulatory requirements while delivering exceptional user engagement.

The convergence of education and gaming represents a ₹18,000 crore opportunity that Indian developers can capture without regulatory concerns, positioning them as global leaders in educational gaming technology.

Regional Content Creation Boom

The ban has triggered explosive growth in regional and vernacular gaming content. Startups developing games in Hindi, Tamil, Bengali, and other Indian languages are seeing unprecedented user adoption rates.

Nazara Technologies reported that their regional gaming portfolio grew 290% quarter-over-quarter following the ban, as users gravitated toward culturally relevant, compliant gaming experiences.

Regional Gaming Success Stories:

- Tamil gaming apps: 400% user base expansion

- Hindi narrative games: 350% download increases

- Regional sports simulation games: 275% engagement growth

Social Gaming Communities Thrive

Community-driven gaming platforms are experiencing their breakout moment. Discord-style gaming communities built around Indian interests and languages have seen explosive growth, with some platforms adding 100,000+ users weekly.

Startup opportunities in community gaming include:

- Regional tournament platforms for traditional Indian games

- Social clubs for collaborative puzzle solving

- Cultural celebration gaming experiences

- Local sports fantasy leagues (non-monetary)

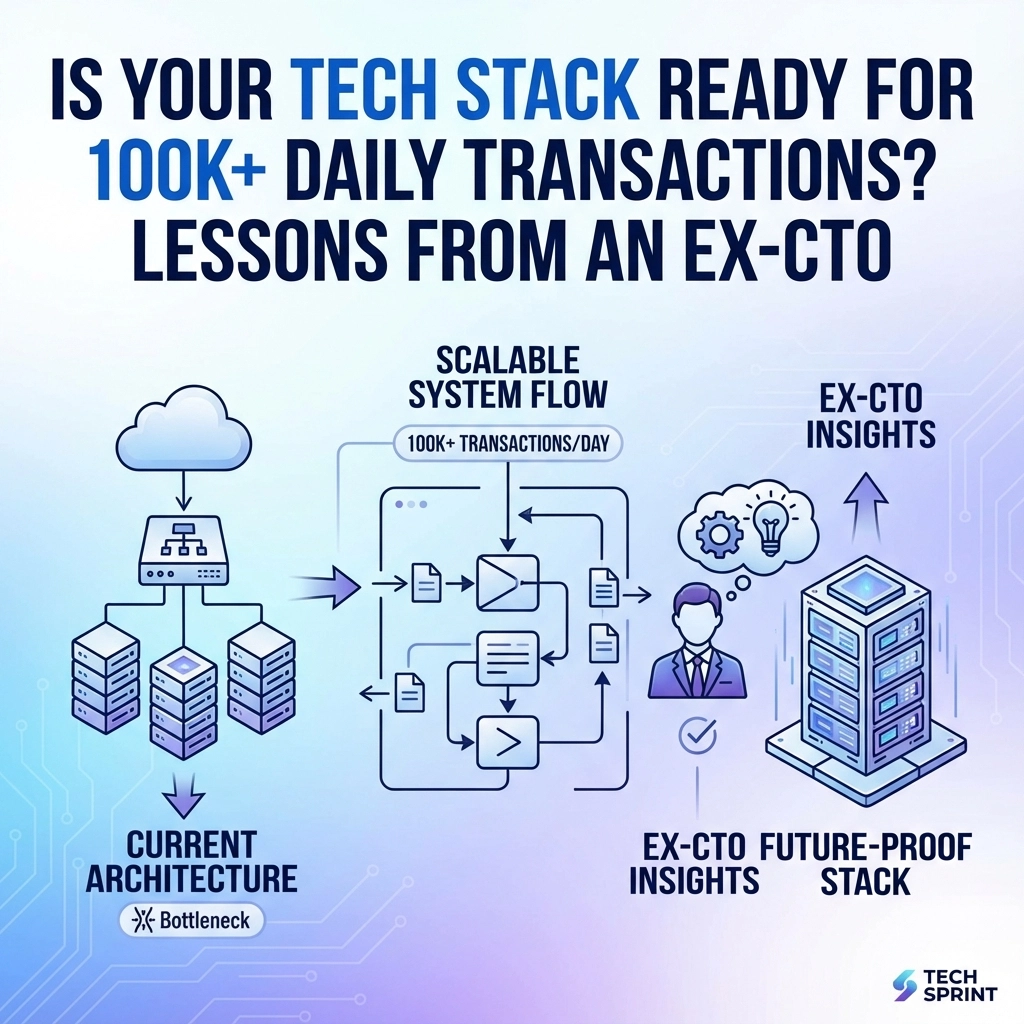

Tech Infrastructure Opportunities

The gaming ban has created massive demand for compliant gaming infrastructure services. Indian startups specializing in gaming analytics, community management, and content moderation are scaling rapidly to serve the emerging market.

Gaming-as-a-Service (GaaS) platforms specifically designed for regulatory compliance represent a blue-ocean opportunity. Early movers in this space are securing multi-year contracts with established gaming companies seeking compliant solutions.

Investment Capital Is Redirecting, Not Disappearing

₹8,400 crores in gaming investment capital is actively seeking new opportunities following the real-money gaming shutdown. Venture capital firms are specifically targeting skill-based and educational gaming startups.

Sequoia Capital India announced a dedicated ₹500 crore fund for compliant gaming innovation, while Accel Partners increased their gaming sector allocation by 180% to focus on regulatory-friendly startups.

Current Investment Focus Areas:

- Skill-based competitive platforms: 35% of new gaming investments

- Educational gaming technology: 28% investment allocation

- Social and community gaming: 22% venture focus

- Gaming infrastructure services: 15% capital deployment

Global Market Positioning Advantage

Indian gaming startups now have a unique competitive advantage in international markets. Companies that successfully navigate India's strict regulatory environment are exceptionally well-prepared for compliance requirements in other markets.

Several Indian gaming companies have already secured distribution partnerships in Southeast Asia, the Middle East, and Latin America, leveraging their compliance expertise as a key differentiator.

Technical Innovation Acceleration

The ban has accelerated technical innovation in gaming AI, user experience design, and community engagement systems. Startups are developing sophisticated algorithms for skill assessment, fair play detection, and educational progress tracking.

Indian gaming companies are filing 40% more technology patents compared to pre-ban periods, focusing on innovative solutions for compliant gaming experiences.

Platform Integration Opportunities

Major technology platforms are actively seeking Indian gaming partners for integrated experiences. WhatsApp, Instagram, and YouTube are prioritizing partnerships with compliant Indian gaming startups for mini-games and social experiences.

Google Play Store India has created a dedicated "Made in India Gaming" category with preferential discovery algorithms for compliant local gaming apps, providing unprecedented visibility opportunities for emerging startups.

The Road Ahead: Sustainable Growth Models

Indian gaming startups operating within regulatory guidelines are building fundamentally stronger business models than their real-money gaming predecessors. Focus on user engagement, educational value, and community building creates sustainable revenue streams through subscriptions, in-app purchases for cosmetic items, and premium feature access.

The ban has eliminated unsustainable business models while amplifying opportunities for authentic innovation. Forward-thinking entrepreneurs recognize that regulatory compliance, combined with India's massive gaming audience of 420 million users, creates the perfect storm for building the next generation of global gaming giants.

Within 18 months, analysts predict that India's compliant gaming sector will employ more professionals than the pre-ban industry ever did – with the critical difference being sustainable, regulation-proof career opportunities that can scale globally.

The gaming ban hasn't closed doors for Indian startups – it's opened the right ones. Companies building for compliance, community, and genuine user value are positioned to dominate not just Indian markets, but to establish India as the global epicenter of responsible gaming innovation.