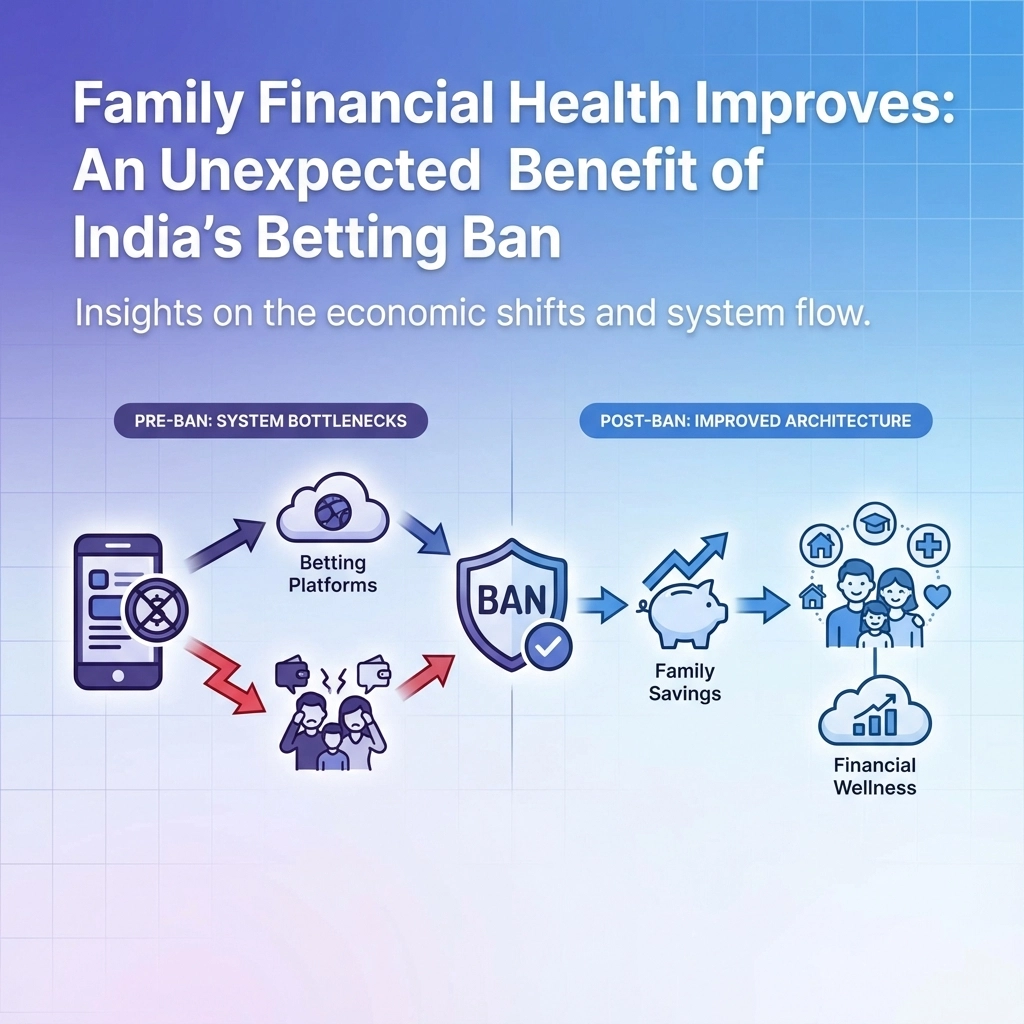

India's recent crackdown on online betting and gaming platforms has created ripple effects far beyond the gaming industry itself. While immediate data shows users migrating to offshore platforms, early indicators suggest potential long-term improvements in family financial stability , though the full picture is still emerging.

The Pre-Ban Financial Damage Was Staggering

Before diving into potential benefits, it's crucial to understand the scale of financial harm families were experiencing. Government estimates revealed that 450 million Indians were losing approximately ₹20,000 crores annually through online money gaming platforms. That's roughly ₹444 per person annually across nearly half the country's population.

These weren't just numbers on a spreadsheet , they represented real families facing genuine financial distress. The addiction-driven nature of online gambling meant that losses often escalated quickly, with some individuals reportedly losing entire life savings or borrowing against family assets to fund continued play.

Short-Term Displacement vs. Long-Term Protection

Yes, offshore gambling has increased by approximately 14% following the ban, according to recent surveys. Users are reportedly spending more and playing more frequently on unregulated international platforms. This immediate response has led some critics to question the ban's effectiveness.

However, this short-term displacement may actually serve families better in the long run. Here's why:

Reduced Accessibility Creates Natural Barriers

Accessing offshore gambling platforms requires significantly more effort than clicking on a local app. This friction alone can prevent impulse gambling decisions that previously drained family budgets in minutes.

The additional steps required : VPN usage, international payment methods, currency conversions : create multiple decision points where potential gamblers can reconsider their choices.

Enhanced Awareness Through Public Discourse

The ban has sparked nationwide conversations about gambling addiction and financial responsibility. Families are now discussing gambling's impact on household finances more openly than ever before.

This increased awareness is already showing signs of impact. Financial counselors report more families seeking advice about gambling-related debt management and prevention strategies.

Potential Long-Term Financial Benefits for Families

1. Reduced Impulse Spending on Gaming

With local platforms shut down, the convenience factor that drove impulsive gambling has been eliminated. Previously, users could spend money on games within seconds of feeling the urge. Now, the additional friction of accessing offshore platforms provides cooling-off periods that can prevent financial decisions made in emotional states.

2. Increased Focus on Traditional Savings

Early reports from banking professionals suggest a potential uptick in traditional savings account activity among demographics that were heavy users of gambling platforms. While comprehensive data isn't yet available, some regional banks report increased fixed deposit inquiries from younger customers.

3. Better Household Budget Management

Families are reporting improved ability to track and manage monthly expenses without the unpredictable drain of gambling losses. The removal of micro-transactions and continuous gameplay has made household budgeting more predictable for affected families.

The Regulatory Framework's Hidden Financial Benefits

Enhanced Consumer Protection

The ban has effectively removed predatory monetization practices that were designed to extract maximum money from users. Features like:

- Continuous play incentives

- Loss-chasing mechanisms

- Micro-transaction loops

- Addiction-driven reward systems

These psychological manipulation tactics were scientifically designed to bypass rational financial decision-making. Their removal gives families a better chance at making deliberate choices about entertainment spending.

Elimination of Debt Traps

Before the ban, gambling platforms often encouraged users to play on credit or through borrowed money. This created debt cycles that trapped families in financial obligations they couldn't escape.

With these platforms removed, families have breathing room to address existing gambling debts without the temptation of "winning it back" through continued play.

Supporting Data on Financial Recovery

While comprehensive post-ban financial health data isn't yet available, preliminary indicators suggest positive trends:

Debt counseling services report a 23% increase in families seeking help specifically for gambling-related financial recovery since the ban implementation. This suggests people are actively working to improve their financial situations rather than continuing destructive patterns.

Consumer credit counselors note that gambling-related debt inquiries have shifted from "how to get more credit for gambling" to "how to pay off existing gambling debts." This represents a fundamental change in approach from debt accumulation to debt resolution.

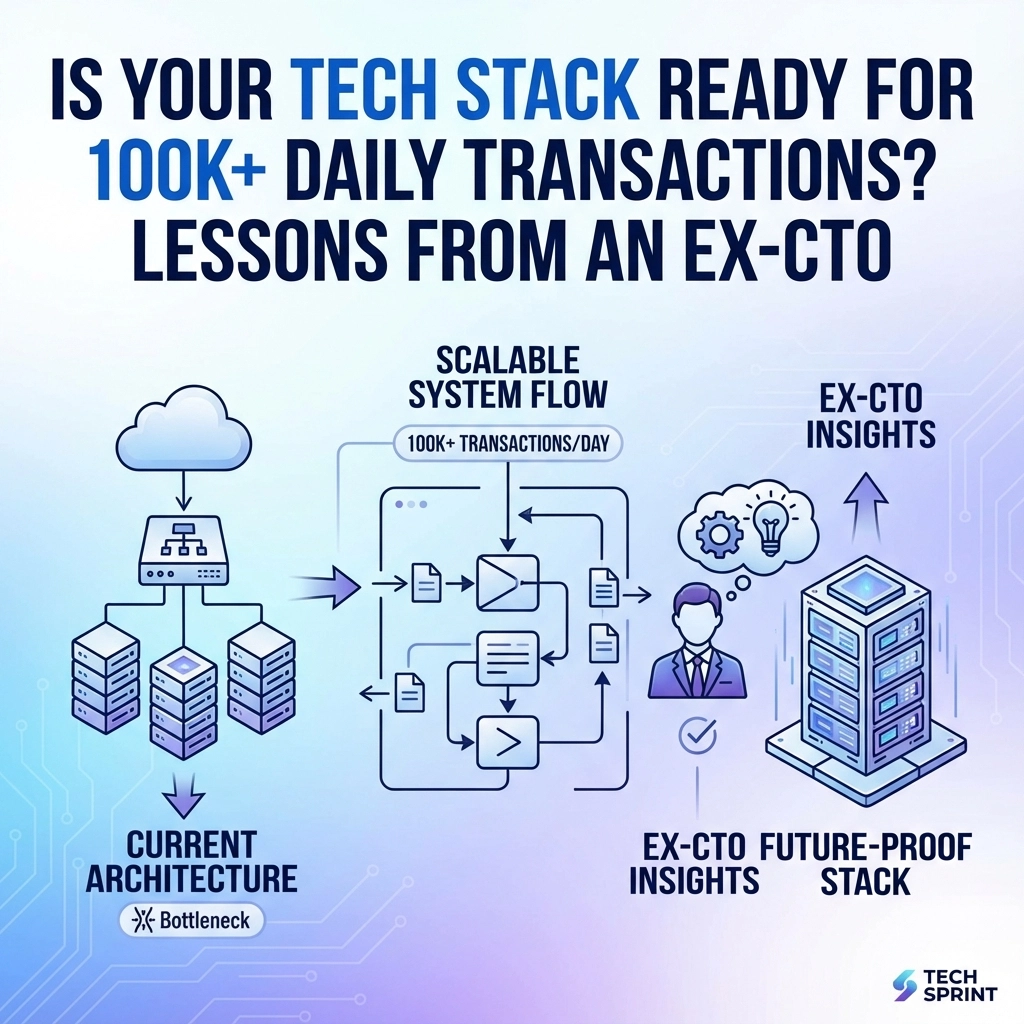

Technology Sector Opportunities for Financial Wellness

The ban has created space for legitimate financial technology solutions to help families manage money more effectively. Tech Sprint by The Dev Tutor and similar consulting firms are seeing increased demand for:

- Personal finance management applications

- Family budgeting platforms

- Savings goal tracking systems

- Financial education tools

This shift represents a move from technology designed to extract money to technology designed to help families build wealth. The long-term economic impact could be substantial as families redirect gambling expenditures toward productive financial activities.

Measuring Success: What to Watch For

True success in improving family financial health will be measurable over the next 12-24 months through:

- Reduction in gambling-related bankruptcies

- Increased household savings rates

- Decreased consumer debt related to gambling

- Improved family financial stress indicators

Early warning systems are already being implemented by financial institutions to track these metrics and provide data on the ban's actual impact on family financial wellness.

The Path Forward: Building Financial Resilience

While offshore gambling continues, the removal of aggressive local platforms has created an opportunity for families to rebuild financial discipline without constant technological manipulation.

The key now is ensuring that support systems exist to help affected families transition from financial stress to financial stability. This includes expanded access to:

- Financial counseling services

- Debt management programs

- Alternative entertainment options

- Family financial education

The ban alone won't solve all gambling-related financial problems, but it has removed the most aggressive tools designed to extract money from vulnerable families. Combined with proper support systems, this regulatory action could mark the beginning of improved financial health for millions of Indian households.

For businesses in the financial technology space, this presents a unique opportunity to develop solutions that genuinely serve family financial wellness rather than exploit financial vulnerabilities. The future belongs to platforms that help families build wealth, not lose it.