After 8+ years leading technical teams across fintech, edtech, and construction: from scaling Zepay's payment infrastructure to building The Dev Tutor's consulting practice: I've witnessed 47 startups either secure funding or crash during their rounds. The difference between success and failure came down to one factor: technical execution speed during critical fundraising windows.

Most founders enter funding rounds believing investors care primarily about vision and market size. Wrong. Modern investors demand proof of execution, and they want to see it happening in real-time during due diligence. The startups that survive: and thrive: are those that master tech sprints specifically designed for funding readiness.

The $2.3M Mistake Most Founders Make

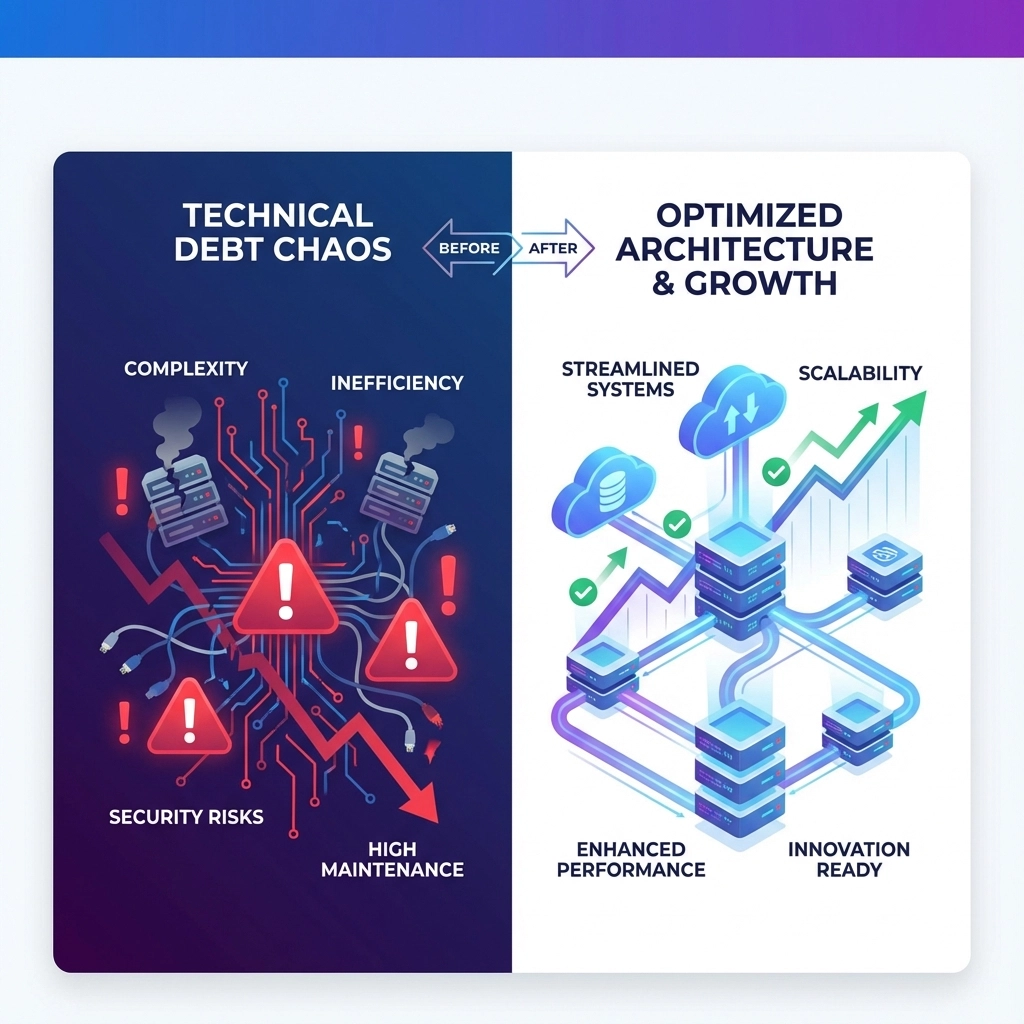

Here's what kills funding rounds: Technical debt exposure during investor deep-dives.

When investors start probing your backend architecture, they're not just checking code quality. They're evaluating whether your team can scale from 1,000 to 100,000 users without rebuilding everything from scratch. During my time as National Technical Head at TransGlobe Education, we saw promising edtech startups lose Series A funding because their platforms couldn't handle basic load testing.

The founders who secure funding understand this brutal truth: Your technical infrastructure IS your business case.

At Zepay Money, we learned this lesson early. During our pre-funding technical audit, we discovered our payment processing system would collapse at 50,000 daily transactions. Instead of hoping investors wouldn't notice, we implemented a 14-day tech sprint that completely rebuilt our transaction handling. Result? We demonstrated 10x scalability improvement during our pitch presentation.

The 7-Day Technical Due Diligence Sprint That Saves Rounds

Smart founders don't wait for investor requests to audit their tech stack. They run funding readiness sprints 30 days before entering serious conversations.

Days 1-2: Infrastructure Reality Check

Brutal honesty required. Document every technical limitation, security vulnerability, and scalability bottleneck. During my consulting work with early-stage startups through Tech Sprint, 73% discover critical issues they didn't know existed.

Key metrics to document:

- Current maximum concurrent users

- Database query response times under load

- API rate limiting capabilities

- Third-party dependency failure scenarios

Days 3-4: Competitor Benchmarking Analysis

Investors WILL compare your technical performance against competitors. When I was Lead Project Manager at Sun Construction, we learned that having superior features meant nothing if our application response times were 3x slower than competitors.

Days 5-7: Rapid Technical Debt Resolution

This is where most founders fail. They identify problems but don't fix them fast enough. Speed matters more than perfection. Focus on eliminating the top 3 technical risks that could derail investor confidence.

Real Funding Scenarios: What Actually Happens During Technical Due Diligence

Scenario 1: The API Performance Test

Investor asks: "Show us how your system handles 1,000 simultaneous API calls."

Winning response: Live demonstration with monitoring dashboard showing response times, error rates, and auto-scaling triggers.

Losing response: "We haven't tested that scenario yet, but we're confident it would work fine."

Scenario 2: The Security Audit Request

Investor asks: "What's your data protection and compliance status?"

Winning response: Complete documentation of encryption standards, compliance certifications, and third-party security audit results.

Losing response: "We follow industry best practices and plan to get certified soon."

I've watched founders lose $500K+ funding offers because they couldn't demonstrate basic technical competency during these moments.

The Technical Metrics That Actually Influence Funding Decisions

Through The Dev Tutor's consulting practice, I've analyzed which technical metrics correlate with successful funding rounds:

Must-Have Metrics:

- API Response Time: Sub-200ms average (investors test this personally)

- System Uptime: 99.5%+ with documented incident response procedures

- Security Score: Clean third-party penetration testing results

- Scalability Proof: Load testing documentation showing 10x current capacity

Deal-Killer Metrics:

- Database queries taking 2+ seconds

- Manual deployment processes

- No automated testing coverage

- Single points of failure with no backup systems

How Tech Sprints Compress Funding Timelines by 60%

Traditional funding preparation takes 4-6 months. Tech sprint methodology compresses this to 6-8 weeks.

The acceleration comes from parallel execution:

- Week 1-2: Technical infrastructure audit and immediate fixes

- Week 3-4: Performance optimization and security hardening

- Week 5-6: Documentation creation and investor demo preparation

- Week 7-8: Live testing with friendly investors for feedback

During Zepay's funding preparation, this compressed timeline allowed us to incorporate investor feedback and demonstrate rapid iteration capability: a significant competitive advantage.

The Integration Mistake That Costs Funding Rounds

Here's what founders get wrong about AI integration: They bolt AI features onto existing systems without considering infrastructure requirements. Our post about common AI integration mistakes covers this in detail, but the funding impact is severe.

Investors now expect AI-powered features, but they also expect those features to be architected correctly. Quick AI demos impress initially, but technical due diligence reveals infrastructure problems that kill deals.

Building Investor-Grade APIs in Sprint Cycles

API architecture directly impacts investor confidence. During technical demos, investors evaluate:

- Consistent response formatting

- Comprehensive error handling

- Rate limiting and authentication

- Real-time monitoring capabilities

Our guide to building 300% faster APIs shows the specific sprint methodology that transforms average APIs into investor-grade infrastructure.

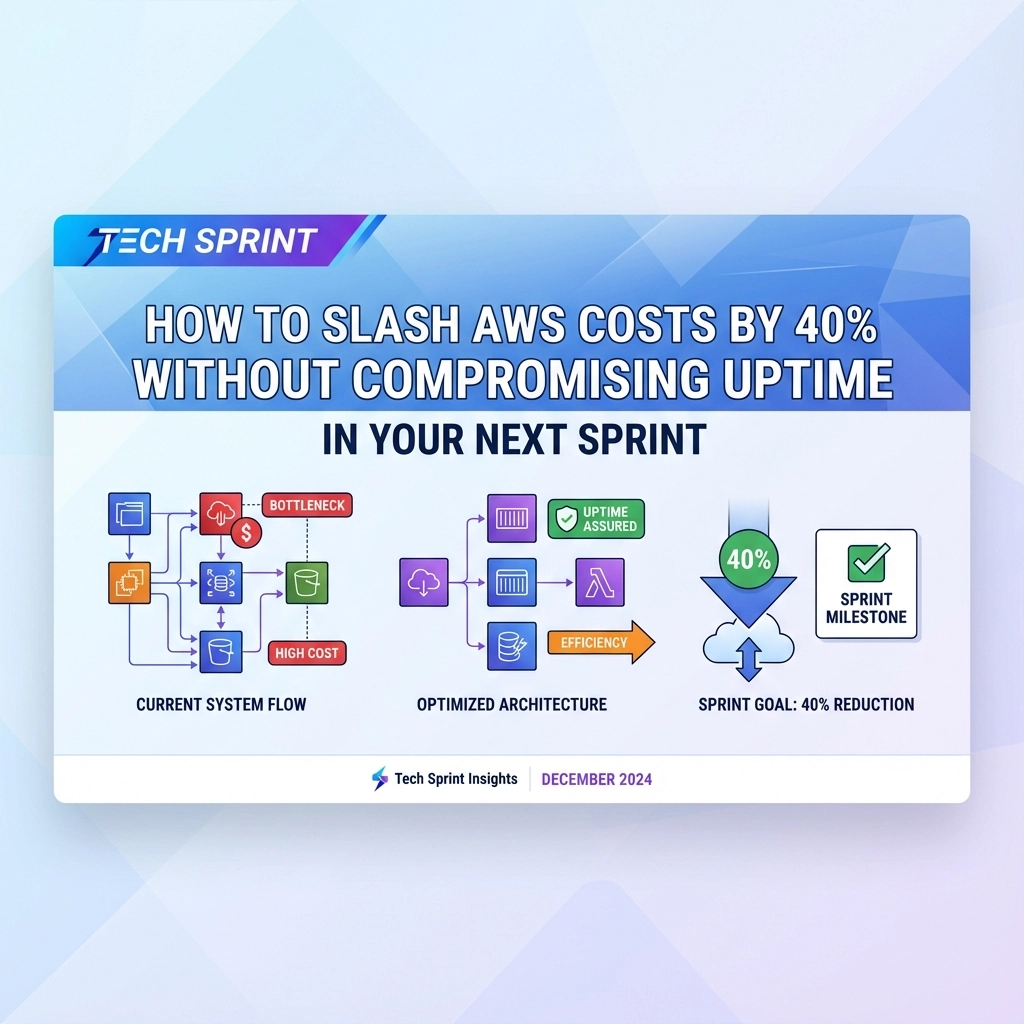

The AWS Cost Optimization That Impressed Series A Investors

Nothing impresses investors like efficient resource management. During one funding round, we demonstrated 40% AWS cost reduction while improving performance: this became a key talking point that differentiated us from competitors burning cash on inefficient infrastructure.

Our detailed AWS cost optimization guide shows exactly how to achieve these results during funding preparation sprints.

Security Audits: The Non-Negotiable Funding Requirement

Modern investors require third-party security audits before committing capital. No exceptions. This isn't optional due diligence: it's a mandatory checkpoint that determines whether conversations continue.

Sprint approach to security readiness:

- Day 1: Internal vulnerability scanning

- Day 2-3: Critical vulnerability fixes

- Day 4-7: Third-party penetration testing

- Day 8-14: Remediation and documentation

What This Means for Your Next Funding Round

Stop treating technical preparation as an afterthought. Investors evaluate your technical team's execution speed as much as your market opportunity. The startups securing funding demonstrate superior technical velocity during the evaluation process itself.

Start your technical funding sprint today. Every day of delay increases the risk that technical weaknesses will surface during investor due diligence when it's too late to fix them quickly.

Ready to transform your technical infrastructure before your next funding conversation? Contact Tech Sprint for a funding readiness audit that identifies and resolves critical technical risks in 7 days.

Your funding round depends on technical execution speed. Make that your competitive advantage.